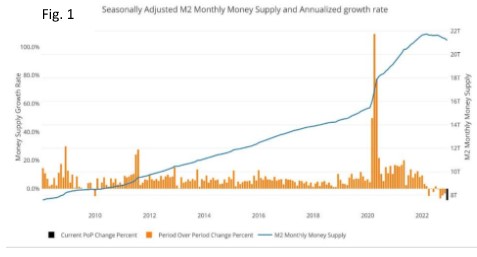

After an abysmal first three quarters for stock and bond markets, the fourth quarter provided some welcomed relief, although not enough to change the outcome for 2022. It was the worst calendar year for growth stocks in over a decade, while bond markets posted their biggest losses in modern history. The overriding story of importance in our opinion was the result of massive expansion of the money supply (M2) in 2021 and 2022. The excess M2 in the American system directly lead to the rising prices all Americans are experiencing today (see Fig. 1). The Fed began combating this inflation by raising interest rates at the fastest pace in history.

After an abysmal first three quarters for stock and bond markets, the fourth quarter provided some welcomed relief, although not enough to change the outcome for 2022. It was the worst calendar year for growth stocks in over a decade, while bond markets posted their biggest losses in modern history. The overriding story of importance in our opinion was the result of massive expansion of the money supply (M2) in 2021 and 2022. The excess M2 in the American system directly lead to the rising prices all Americans are experiencing today (see Fig. 1). The Fed began combating this inflation by raising interest rates at the fastest pace in history.

Unfortunately, as we mentioned last quarter, the Fed Funds rate must be raised sufficiently above the historical 4% “neutral rate” in order to bring inflation back down. We ended Q4 with the Fed Funds rate at 4.25%-4.50% and a shrinking M2 for the first time on record after the unprecedented 2020-21 expansion. The Fed instituted additional corrective measures by allowing $95 billion of treasuries and mortgage-backed securities to roll off the balance sheet each month, further tightening cash in the system. Just how far the Fed will need to raise rates and tighten the money supply to bring down inflation is yet to be determined.

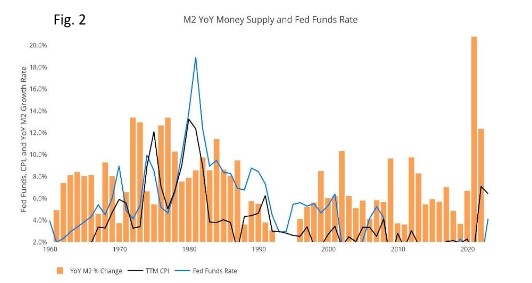

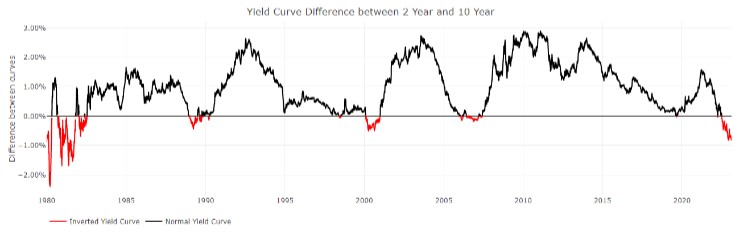

As you can see from Fig. 2, inflation, measured by CPI, is still significantly above the current Fed Funds rate, indicating further rate hikes may be necessary. Remember, monetary policy tools such as these act with a lag and will take some time to see effect. The anticipated result by many economic forecasters is stagnant economic growth and a possible recession in the months ahead. Adding additional worry to recession fears, the 2-year U.S. Treasuries are trading above the 10-year U.S. Treasuries to the largest extent since the early 1980s and continually since July 2022.

As you can see from Fig. 2, inflation, measured by CPI, is still significantly above the current Fed Funds rate, indicating further rate hikes may be necessary. Remember, monetary policy tools such as these act with a lag and will take some time to see effect. The anticipated result by many economic forecasters is stagnant economic growth and a possible recession in the months ahead. Adding additional worry to recession fears, the 2-year U.S. Treasuries are trading above the 10-year U.S. Treasuries to the largest extent since the early 1980s and continually since July 2022.

The inverted yield curve is historically a sign of investor pessimism and a precursor to recession (see Fig.3). Major stock indices posted welcomed gains of 7.6% and 16% for the S&P 500 and the DJ Industrial Average in Q4, while the NASDAQ Composite Index was flat. For calendar year 2022, they plummeted -18.1%, -6.9% and -32.4% respectively. Internationally, the EAFE gained 17.3% in Q4 while declining -14.5% for the full year. In bonds, it was a similar story to stocks as the U.S Aggregate Bond index gained 1.9% in Q4 while declining a whopping -13.0% for the 2022 year. Cryptocurrencies, once hoped to be a stable alternative to cash, failed to live up to the hype, as the most widely held Bitcoin plunged -64.7% for the year. After the huge yearly selloff, the average stock in Morningstar’s coverage universe was undervalued by 16% at the end of Q4. Communication Services represented the biggest bargain, trading 43% below fair value. Consumer Cyclical at 30% and Technology at 19% discount represented the next largest percentages under fair value. Conversely, Energy led all sectors ending the quarter 12% over fair value.

Utilities finished 5% overvalued, followed by Consumer Defensive and Healthcare at 4%1. Even after the large annual decline, the S&P 500 surprisingly ended the year 31.8% overvalued from a Price/Earnings (P/E) standpoint, down from a peak of 165% overvalued in December 2020. On the commodity side, crude oil ended the quarter up slightly at 1.3%, while ending the year 7.0% higher than it ended 2021. Gold ended 2022 at $1,819.70 per ounce, almost exactly where it began the year at $1,827.50. Although slightly lower, gold provided a reasonable hedge to the substantial declines experienced in the equity markets. We’re echoing the sentiment of most economists and are expecting a lessening of inflation and subsequent easing of monetary policy in the second half of the New Year. We’re recommending an allocation that is more heavily weighted towards larger capitalization value stocks that have wide economic moats; greater pricing power and can generate excess returns during market downturns. In addition, having a larger than normal allocation to higher yielding cash will provide a ballast during these turbulent markets. While 2022 proved to be the most challenging year in recent memory for investable assets, we look forward to continually earning your business and your trust in 2023.

Utilities finished 5% overvalued, followed by Consumer Defensive and Healthcare at 4%1. Even after the large annual decline, the S&P 500 surprisingly ended the year 31.8% overvalued from a Price/Earnings (P/E) standpoint, down from a peak of 165% overvalued in December 2020. On the commodity side, crude oil ended the quarter up slightly at 1.3%, while ending the year 7.0% higher than it ended 2021. Gold ended 2022 at $1,819.70 per ounce, almost exactly where it began the year at $1,827.50. Although slightly lower, gold provided a reasonable hedge to the substantial declines experienced in the equity markets. We’re echoing the sentiment of most economists and are expecting a lessening of inflation and subsequent easing of monetary policy in the second half of the New Year. We’re recommending an allocation that is more heavily weighted towards larger capitalization value stocks that have wide economic moats; greater pricing power and can generate excess returns during market downturns. In addition, having a larger than normal allocation to higher yielding cash will provide a ballast during these turbulent markets. While 2022 proved to be the most challenging year in recent memory for investable assets, we look forward to continually earning your business and your trust in 2023.

Jack A. Kennedy

Chief Investment Officer